Reporting Single Touch Payroll in MYOB

Rebecca MacGregor-Fraser: rebeccafraser@klmaccountants.com.au

Zoe Dooley: zoe@klmaccountants.com.au

02 4908 0400

MYOB has worked directly with the Australian Taxation Office (ATO) to ensure that you’re ready to go for Single Touch Payroll (STP) reporting.

What do I need to do?:

Determine if your current MYOB version is STP enabled:

YES:

MYOB AccountRight Live or MYOB Essentials – STP Ready (You can report Single Touch Payroll to the ATO directly from AccountRight 2018.2 and later versions)

NO:

AccountRight Plus, Premier, Enterprise and AccountEdge are not STP compatible and there are no plans to do so. You will need to migrate to MYOB AccountRight 2018.2 or later or convert to another STP ready payroll software to be STP ready.

If you are thinking of changing to an alternative accounting software please contact our in-house bookkeepers to discuss online accounting software solutions.

For MYOB PayGlobal – Please contact support on support@payglobal.com or speak to your account manager directly

Check if you can upgrade:

If you use the following Classic AccountRight features, you won’t be able to upgrade from AccountRight Classic (v19 or earlier) just yet because these features aren’t available in the new AccountRight:

- M-Powered Payments

- multi-currency (some multi-currency files can be upgraded, but conditions apply

- negative inventory or multi-location stock tracking

- add-ons that require Are your add-ons compatible?

How do I upgrade?:

- You will need a current MYOB subscription to If you do not currently pay an annual/monthly fee please contact MYOB or Rebecca MacGregor-Fraser or Zoe Dooley of our office to organise.

- You will need to know your MYOB serial To locate your MYOB serial number:

- Open your MYOB file

- Select Setup > Company Information

- Serial Number is in the top left hand corner

- Download and install current AccountRight

- Upload your company file:

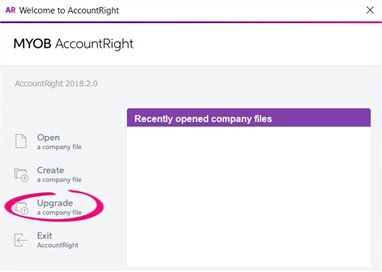

- Open AccountRight and select Upgrade a Company File

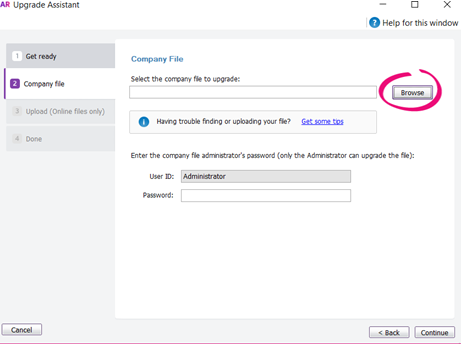

- Click Upgrade a company file. The Upgrade Assistant appears.

- Click Continue and on the Company file page, click Browse to locate and select the file you want to upgrade.

- If the file you are upgrading is password-protected, type in the password and click Continue. If you’re not sure of the Administrator password, try leaving it blank.

- Sign in to AccountRight with your MYOB account details and then click Upload. Once your file has uploaded, you can close AccountRight while we do the Myob will email when the upgrade is complete.

IMPORTANT: Please note you should not use MYOB again until the upgrade is complete or you will have to re-enter your data. Once you have upgraded please ensure you only open through the updated MYOB. Do not open with the old version!

How do I set up single touch payroll?:

- Step 1 – Check your company information:

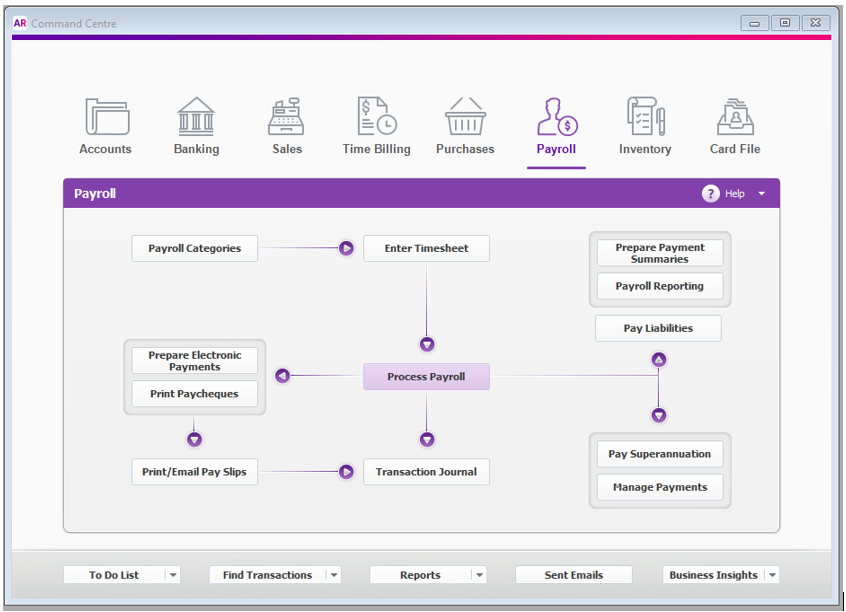

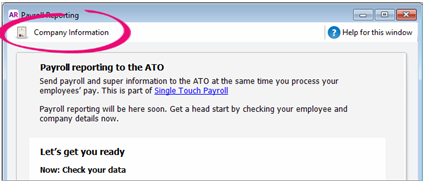

- Go to the Payroll command centre and click Payroll Reporting.

- Click Company Information.

Check company details are correct (including ABN)

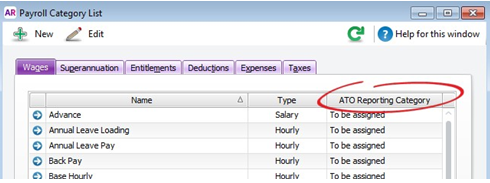

Step 2 – Assign ATO reporting categories:

- Go to the Payroll command centre and select Payroll Categories. A list of your Wages categories appears.

- Click a category to open The ATO Reporting Category column shows the category assigned.

- Select the appropriate category from the ATO Reporting Category list and select OK.

- Repeat for all wage payroll categories (see Wages info below for more info).

- Select the Superannuation tab and repeat the steps to assign categories.

- Repeat for all categories in the Deductions and Tax Please refer for further assistance;

http://help.myob.com/wiki/display/ar/Assign+ATO+reporting+categories+for+Single+To uch+Payroll+reporting

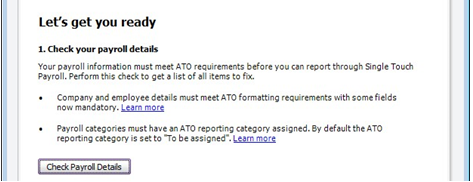

Step 3 – Check your payroll details

- Go to the Payroll command centre and click Payroll Reporting.

- Click Check Payroll Details. The Check Payroll Details window appears listing the From this list you’ll see what items you need to fix before you can connect to the ATO and start reporting using Single Touch Payroll.

Step 4 – Fix errors if you have any.

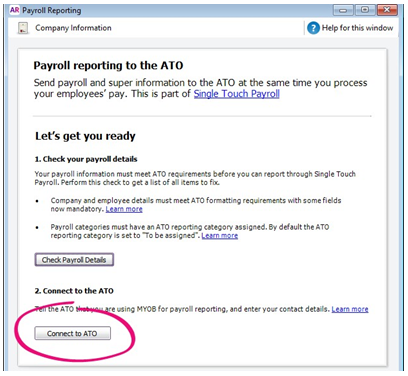

Step 5 – Connect to the ATO:

Please note: Each person who processes payroll for your business needs to complete these steps

- From Payroll command centre > Payroll Reporting select Connect to the ATO

- If prompted, click Check Payroll Details to fix any issues with your payroll setup.

- Select Start

- Select your role (Someone from the Business) and continue

- Enter the business ABN and your contact details

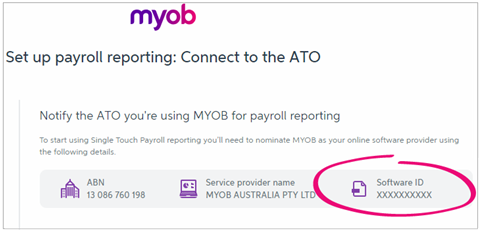

- At the Notify ATO screen you will see a Software ID number:

This is unique to you and you can’t share it – each client and agent will have their own. You’ll get this number when you complete the steps to connect to the ATO.

Step 6 – Notify the ATO

- Call the ATO on 1300 852

- Follow the prompts and provide your unique Software ID and MYOB details as per your MYOB file when requested.

- Once the ATO have been advised select I’ve notified the ATO.

What happens after I’ve set up Single Touch Payroll reporting?:

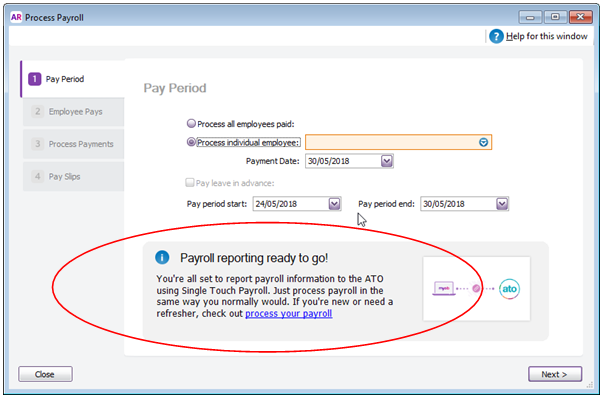

You will know you are set up for Single Touch Payroll when you see the following message in the Pay Period window when you go to complete your next payrun (Payroll > Process Payroll):

When you click Record to record a pay run, you’ll be prompted to declare and submit the information to the ATO. You’ll only be able to do this if you’ve completed the Connect to the ATO steps.

What if I make a mistake in a pay run?:

If you over or under pay an employee, just fix it as you normally would. This corrects the employee’s YTD amounts, which will be sent to the ATO the next time you declare a pay run. The ATO have advised you must amend an error within 14 days.