Reporting Single Touch Payroll in Xero

Rebecca MacGregor-Fraser: rebeccafraser@klmaccountants.com.au

Zoe Dooley: zoe@klmaccountants.com.au

02 4908 0400

How to opt in to Single Touch Payroll (STP):

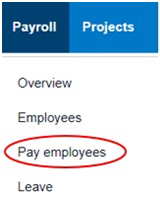

- In the Payroll menu, select Pay employees.

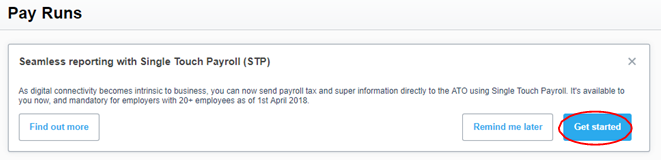

- In the message about Seamless reporting with (STP), click Get started.

- Click Opt in to confirm.

- Review your business organisation details and select continue

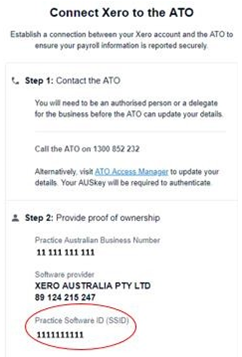

- On the Connect to the ATO screen, locate your individual SSID number and contact the ATO on 1300 852 232 and advise your nominated software is Xero and the SSID (You will need to provide proof of ownership by providing your ABN)

- Once the ATO have been advised select the checkbox to confirm you’ve contacted the ATO to connect your Xero account.

- Click Register. Xero will redirect you back to the Pay employees page.

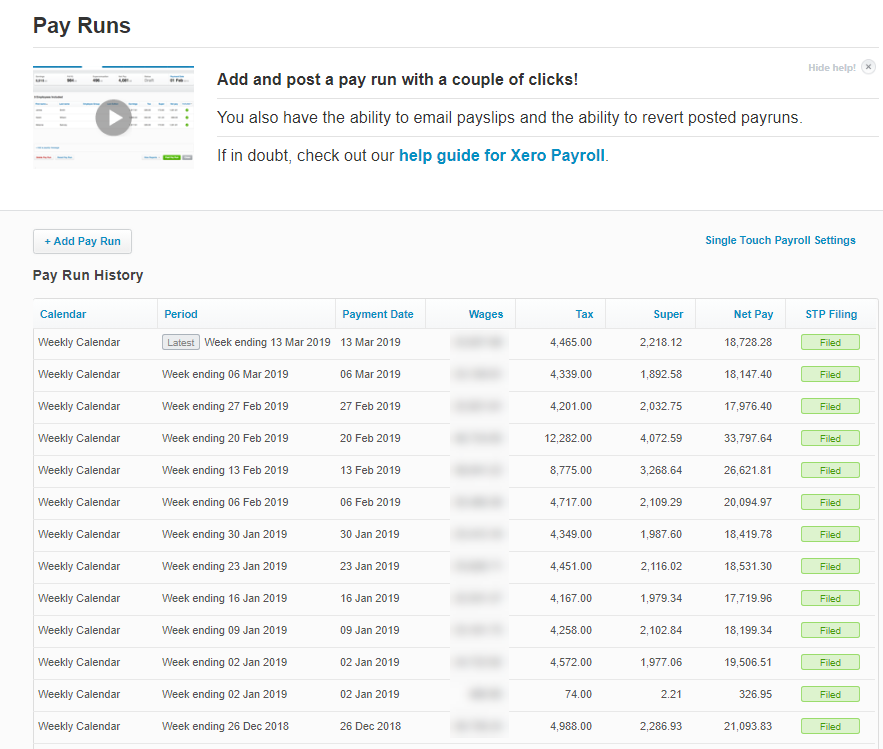

You’ll now see an STP filing column in the Pay Run History table.

Filing with Single Touch Payroll:

- In the Payroll menu, select Pay employees.

- Process a pay run or click a past pay run that requires You can see the filing status of a pay run under the STP filing column (e.g. Pending, Filed or Failed).

- If prompted, add types to allowance pay items in your pay run.

- Click File, then click File now.

Xero lists the STP filing status as Pending until the ATO accepts or declines the submission.

What if I make a mistake in a pay run?:

If you over or under pay an employee, just fix it as you normally would. This corrects the employee’s YTD amounts, which will be sent to the ATO the next time you declare a pay run. The ATO have advised you must amend an error within 14 days.